CFIN 4 4th Edition Besley Solutions Manual

You may also like

-

$26.50

$50.00 -

$26.50

$50.00 -

$26.50

$50.00 -

$26.50

$50.00 -

$26.50

$50.00 -

$26.50

$50.00

This is completed downloadable of CFIN 4 4th Edition Besley Solutions Manual

Product Details:

- ISBN-10 : 1285434544

- ISBN-13 : 978-1285434544

- Author: Scott Besley, Eugene F. Brigham

Created by the continuous feedback of a “student-tested, faculty-approved” process, CFIN4 delivers a visually appealing, succinct print component, tear-out review cards for students and prep cards for instructors, and a consistent online offering with CourseMate that includes the new MindTap Reader eBook in addition to a set of interactive digital tools including self quizzes, extra problems for practice, downloadable flash cards, quizzes and more–all at a value-based price and proven to increase retention and outcomes. CourseMate for CFIN4 also provides additional online resources such as material on Ethical Dilemmas, to stimulate thought-provoking class discussion. Integrative Problems pull together concepts from each chapter and allow instructors to guide students through a step-by-step process, and apply what they have learned within the chapter to solve realistic business problems.

Table of Content:

Chapter 1

Meaning of finance:

The term finance deals with “decision about money”. Financial decisions deal with how money is raised and used by businesses, government, and individuals.

In business, decisions about cash inflows include for what price products should be sold, how funds should be raised when the firms has good investment opportunities, how much it costs to use investor’s money, and how to invest funds appropriately.

Decisions about cash outflows include what expenses must be incurred, which investments must be purchased.

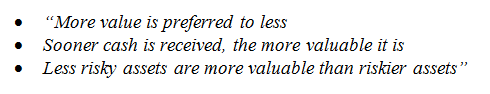

People deal with “financial decisions” both in business and in their personal lives. To make sound financial decision, individual must understand the following three general concepts:

Chapter 2

The stockholders of a publicly traded company normally require the following financial information from the company for at least two recent accounting periods:

• A balance sheet which shows the position of assets and liabilities on a particular date.

• An income statement which shows the revenues and expenses during a particular accounting period.

• The statement of cash flows which includes both inflows and outflows during the accounting period.

• A statement of retained earnings showing the additions and subtractions in the common equity accounts during the accounting period.

It is important that the above financial information is audited by registered and recognized auditors who confirm that the accounts conform to stipulated and recommended accounting standards.

In addition, it is customary that the management also provides an explanatory statement regarding the operations during the accounting period, highlighting the reasons for notable changes in the financial statements between the two periods and the prognosis for the immediate future accounting period.

Though all the financial statements are important from the stockholder’s perspective, the changes in the common equity account reflected by the retained earnings statement is the most important as it reflects the change in value of the stockholder’s investment in the company during the accounting period.

People Also Search:

cfin 4 besley

cfin 4 4th edition besley

cfin 4

cfin 4 4th edition

cfin 4 4th edition download scribd

cfin 4 4th edition solution manual download pdf