Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test Bank

$26.50$50.00 (-47%)

Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test Bank.

You may also like

This is completed downloadable of Fundamentals of Corporate Finance Canadian 6th Edition Brealey Test Bank

Product Details:

- ISBN-10 : 1259024962

- ISBN-13 : 978-1259024962

- Author:

The focus of Brealey et al. Fundamentals of Corporate Finance is on applying modern finance principles, providing students with the ability to make financial decisions as future business professionals. It also delivers a broad introduction to the financial landscape discussing the major players in financial markets, the role of financial institutions in the economy, and how securities are traded and valued by investors.

Recognized for outstanding research, teaching excellence, and their market leading finance texts, the author team’s writing style and approach sets it apart from others – relaxed, interesting, and readable – making the content more inviting for students. Brealey integrates current, real world applications, a variety of problem material and mini cases for students to practice and apply their knowledge.

Table of Content:

Spot market is the cash market in which price is settled in cash instant at current prevailing market prices. While in forward market price is settled on the pre define or future price at specified date.

Exchange rate is the rate at which currency of a country can be converted into other country’s currency. Change in exchange rate could be either good or bad for a particular company.

The cross-exchange rate is a type of exchange rate between the pair of currency in which no currency is the US dollar. This rate can be calculated with the help of US dollar exchange rate for the two currencies.

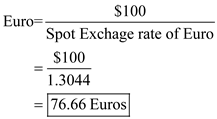

a.

Here calculate the amount of euro which can be purchase from $100:

Therefore, the total Euros will be .

.

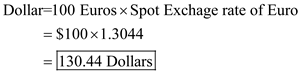

Here calculate the amount of dollar which can be purchase from 100 Euros:

Therefore, the total dollar will be .

.

b.

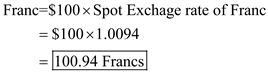

Here calculate the amount of Francs which can be purchase from $100:

Therefore, the total Francs will be .

.

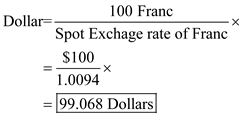

Here calculate the amount of dollar which can be purchase from 100 Francs:

Therefore, the total dollar will be .

.

c.

If the value of the pound reduces, then in that case more pounds can be purchased from $1. Therefore the direct exchange rate of dollar and pound ($/£) will ultimately lessen and on the other side the indirect exchange rate (£/$) will rise.

d.

From the given table the exchange rate of Canadian dollar and U.S. dollar is 1.0326. It means 1.0326 Canadian dollars can buy from 1 U.S. dollar. So, it is clear that the U.S. dollar is worth more than one Canadian dollar.

People Also Search:

fundamentals of corporate finance canadian brealey

fundamentals of corporate finance canadian 6th edition brealey

fundamentals of corporate finance canadian

fundamentals of corporate finance canadian 6th edition

fundamentals of corporate finance canadian 6th edition download scribd

fundamentals of corporate finance canadian 6th edition testbank download pdf